Paypal users have a massive dilemma about whether their bank accounts will get an overdraft.

Having a negative balance in a bank account is an issue, and surely no one wants to experience it. Now, the question is whether Paypal will overdraft its user’s bank account.

Don’t worry. As in this article, I will clear all your confusion. You just need to sit back and go through this article quite thoroughly.

Will PayPal Overdraft bank account?

The burning question right now is whether PayPal will overdraft your bank account, and this is one of the most asked questions about these online payment services.

Let us get this thing straight.

PayPal simply can’t overdraft your bank account, and the reason is that it is just a mere online payment platform and not a financial institution like a bank.

However, if you link your account with a bank account as a primary funding source, there are pros and cons. In that case, you need to ensure a minimum balance in your bank account. Otherwise, the platform PayPal will look for alternative options for the deduction.

What is Paypal

Paypal is one of the most flexible online platforms that facilitate easy online transactions. It is an online medium that helps you pay for particular items through a registered internet account.

If you want to use it for your business, you need to enable your website to direct the customer deposits into your PayPal account.

You can use it to buy items online or even transfer funds to people for a personal account. The best part is that transferring funds between family and friends is totally free.

That said, you can link your bank account with your PayPal account, and you can transfer the funds from the bank and PayPal in the case of any need.

Moreover, PayPal offers many additional benefits that most online payment systems don’t. Compared to most other online payment systems, PayPal is associated with a higher number of websites.

Also, the level of security that PayPal offers is commendable. If you have an account, you won’t have to enter the card CVV every time. Then, a simple login to the account will suffice.

Benefits of linking bank account with PayPal

As an online payment service, PayPal is now widely used on a larger scale. Starting from the small businesses to the big ones, all of them have Paypal listed as a mode of payment on their website. That said, creating and signing up for an account in PayPal is relatively easy.

In addition to this, if you link your bank account, there are some added benefits. These benefits are myriad, and some of the major ones are shortly discussed below:

Security

When it is about money, the first and foremost thing we all are concerned about is its safety and security. With PayPal, there is no issue with the secure transaction of funds. And that said, if you want to connect your bank account with your PayPal account, you can remain tension-free.

It’s completely secure, and all your data is confidential with PayPal. You don’t need to worry about your info getting leaked to any third party at all.

The important thing is that PayPal closely monitors all the linked bank accounts and reviews the transactions to check irregular activity.

Source of Funds

When you link your PayPal account to your bank account, you automatically make your bank account a primary fund source for future purchases through PayPal.

It allows you directly to use the funds from your bank so that you don’t need to transfer the money from your PayPal account additionally.

The only thing you need to ensure is a positive balance in your PayPal account. Only then will the transactions go smoothly.

Zero Fees

Another perk of linking your bank account with PayPal is having almost no fees between transactions or funds transfers. If the case is such that you are using your debit/credit cards, there is always a fee.

But if you have your bank account linked, there is no such thing as fees.

Get Verified

Getting verified by PayPal has a lot of benefits itself. The main distinction between a verified and an unverified Paypal account is that you won’t be able to use the service entirely.

That is, if your account isn’t verified, there is a specific limit about the amount of money that you can withdraw from your bank. However, when you link your bank account to PayPal, it will automatically complete the verification. As a result, there will be an increment in the limits both for spending and withdrawal.

Account Overdrafts with PayPal

There will be issues when you have your bank account linked with your PayPal account as the primary source of funds.

The reason is that when the funds are less in your account, you will not complete your transaction. As a result, the bank will end up charging you a dishonor fee.

And this thing will continue until you have sufficient funds.

Moreover, to mitigate such issues, you need to ensure a sufficient balance in your bank account.

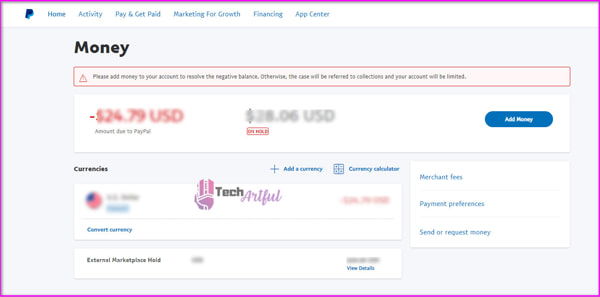

What is a negative balance on PayPal?

The situation of a negative balance in Paypal is when your balance is even lower than zero. It might sound strange, but your balance might get below zero. There can be a lot of reasons behind it, and some of the most prominent are- insufficient funds, lost claims, chargeback, etc.

If any of the reasons are mentioned, you need to refund the exact amount incurred due to the reversed transaction. In addition to this, you will also have to pay the associated fees with PayPal.

In case you fail to do so within an allocated time, your account will get locked.

However, PayPal won’t mitigate the negative balance issue by withdrawing funds from your bank account. Therefore, you don’t need to worry at all.

Final Thoughts

As we are done with this article, you can be tension-free that PayPal will not overdraft your bank account, and it simply doesn’t have that ability usually.

However, linking the bank account can go either way, and it possesses both pros and cons.

And that said, the issue with overdraft will arise only when there is insufficient balance with the linked account.

Moreover, you need to keep these things in check to use PayPal smoothly.